OMERS Investments Appreciate in Worst Market Environment since 2008 Financial Crisis

OMERS, the defined benefit pension plan for municipal sector employees in the province of Ontario, generated a 2022 investment return of 4.2%, net of expenses, adding $4.9 billion of investment income to the Plan. Net assets as at December 31, 2022 were $124.2 billion.

2022 was an exceptionally challenging year for investors globally. Central banks raised interest rates to combat the soaring inflation that resulted from the impact of war and the lingering effects of the COVID-19 pandemic. As a result of these and other factors, global stock and bond markets suffered sharp declines.

“Our investment strategy that emphasizes high-quality assets, diversification, active management, and a disciplined, long-term perspective, served the Plan and our members well in 2022, producing positive returns in a year where broad market indices and the vast majority of investors experienced losses,” said Blake Hutcheson, OMERS President and Chief Executive Officer. “In a difficult environment, our portfolio and the team behind it have performed very well. We are pleased with this outcome and remain focused on the long term. Over 10 years, OMERS has earned an average net return of 7.5%, exceeding our benchmark, and adding $64.4 billion to the Plan.”

“Our significant allocations to private investments and focus on short-term credit over long-term bonds protected OMERS from the worst period of market losses incurred by investors since the 2008 global financial crisis,” said Jonathan Simmons, OMERS Chief Financial and Strategy Officer. “At the same time, investing sustainably continues to be a priority and we have successfully lowered the carbon intensity of our portfolio by 32% since 2019, exceeding our 2025 carbon reduction target.”

“As we look to 2023 and beyond, we will continue to actively create value across the portfolio, selling assets as the right opportunities arise and making new investments that are built for the future,” said Mr. Hutcheson. “We have ample liquidity and are well-positioned globally to pursue emerging investment opportunities that are aligned with our long-term strategy.”

OMERS remains highly rated by four credit rating agencies, including two ‘AAA’ ratings.

Driven and connected by our purpose of delivering on our pension promise to our members, 2022 was a year where we came back together in-person in our global offices to further our work to ensure the Plan remains sustainable, affordable, and meaningful. “We serve the people who keep Ontario’s communities thriving. With a focus that is firmly on the future, we are proud to build tomorrow for our members and their families, and for the generations of members to come,” Mr. Hutcheson concluded.

Further details on OMERS 2022 return can be found in our latest Annual Report, released today.

Media Contact:

Neil Hrab

nhrab@omers.com

416.369.2418

About OMERS

OMERS is a jointly sponsored, defined benefit pension plan, with 1,000 participating employers ranging from large cities to local agencies, and over half a million active, deferred and retired members. Our members include union and non-union employees of municipalities, school boards, local boards, transit systems, electrical utilities, emergency services and children’s aid societies across Ontario. OMERS teams work in Toronto, London, New York, Amsterdam, Luxembourg, Singapore, Sydney and other major cities across North America and Europe – serving members and employers, and originating and managing a diversified portfolio of high-quality investments in public markets, private equity, infrastructure and real estate.

2022 | |

|---|---|

Public Investments | |

Bonds | -3.8% |

Credit | 3.4% |

Public Equity | -11.9% |

Private Investments | |

Private Equity | 13.7% |

Infrastructure | 12.5% |

Real Estate | 13.6% |

Total Net Return | 4.2% |

2021 | |

|---|---|

Public Investments | |

Bonds | 1.3% |

Credit | 5.8% |

Public Equity | 20.7% |

Private Investments | |

Private Equity | 25.8% |

Infrastructure | 10.7% |

Real Estate | 15.9% |

Total Net Return | 15.7% |

Net Investment Returns for the years ended December 31,

2022 | 2021 | |

|---|---|---|

Public Investments | ||

Bonds | -3.8% | 1.3% |

Credit | 3.4% | 5.8% |

Public Equity | -11.9% | 20.7% |

Private Investments | ||

Private Equity | 13.7% | 25.8% |

Infrastructure | 12.5% | 10.7% |

Real Estate | 13.6% | 15.9% |

Total Net Return | 4.2% | 15.7% |

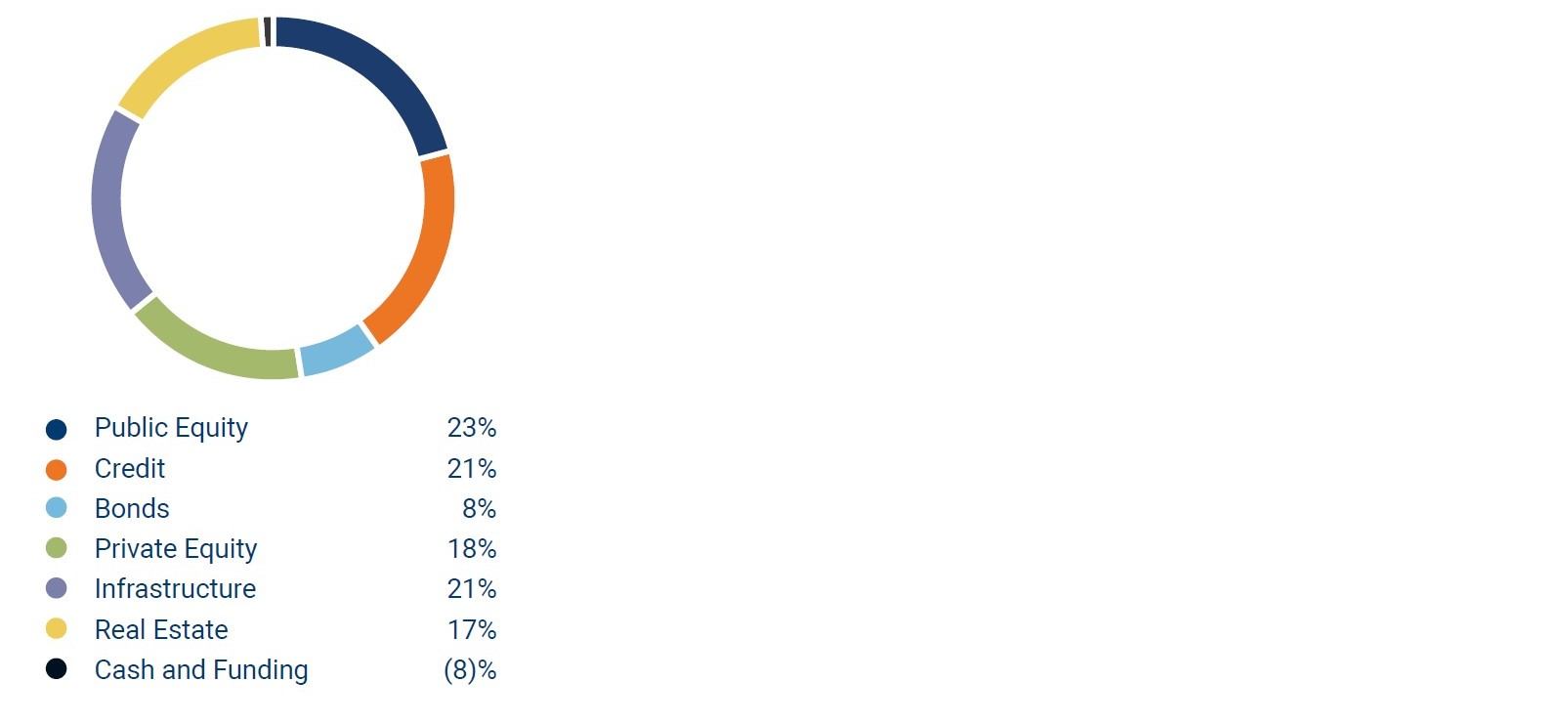

2022 Asset Mix

Transaction Update & Funded Status Update

Investing for Tomorrow

To create value for our members over the long term, OMERS remains focused on strengthening our portfolio and deploying capital towards our target asset mix. We are disciplined as we invest in diverse, high-quality assets that meet the Plan’s risk and return requirements. Please find below highlights of investments made in 2022.

Healthcare and Life Sciences

We believe that investments centred around life sciences and health care make a meaningful difference today, as they support and advance innovative solutions for tomorrow’s medical needs. Over the course of 2022, we:

Formed a partnership with Novaxia to invest in and develop life sciences properties in France and completed the first acquisition under this partnership, acquiring a life sciences campus (Biocitech) in Paris, France, with lab, office and specialist storage.

Established a strategic partnership for the Navy Yard in Philadelphia (US) which will, over time, own and develop up to 3 million square feet of life science properties; and completed the acquisition of a nine-asset, 13-building life sciences portfolio in San Diego’s Sorrento Mesa and Sorrento Valley (US).

Took a minority stake in US-based Medical Knowledge Group, a leading commercialization services platform serving pharmaceutical and biotechnology companies.

Completed a funding round to help Aledade continue scaling its practice management solutions, serving more than 11,000 physicians in 37 US states and the District of Columbia.

Invested in Birdie, a UK-based home healthcare technology company that aims to reinvent care at home and radically improve the lives of millions of older adults.

Made an investment in Ultragenyx Pharmaceutical Inc., which will earn royalties from the future sales of Crysvita®, a drug that is improving the lives of pediatric and adult patients with two rare diseases.

Completed the conversion of the Boren Labs office building to a fully dedicated life sciences facility in downtown Seattle, Washington (US) with tremendous early leasing success.

Led a funding round in Caraway, a hybrid 24-hour healthcare platform focused on women’s health.

Logistics and Transportation

We expect the global growth of e-commerce and demand for expedited supply chains to result in strong long-term demand for logistics and transportation assets. In 2022, we:

Invested in Direct ChassisLink, Inc., one of the largest chassis lessors in the US, with over 151,000 marine and 100,000 domestic chassis in its fleet.

Increased our stake in VTG, Europe’s largest freight railcar lessor.

Announced that existing portfolio investment IndInfravit, which owns a series of toll highways in India, would add additional roads across four states in the country.

Grew our investment in global logistics, including the purchase of a portfolio of seven high quality UK logistics assets.

Announced a first real estate investment in Spain with the acquisition of seven urban logistics assets in prime logistics hubs within the key cities of Barcelona, Bilbao and Tarragona.

Sustainable Investing and Renewables

We have made several investments in assets that address key sustainability issues, and which reflect the growing investor confidence in renewables, while supporting our commitment to achieve our goal of net-zero greenhouse gas emissions by 2050. Other initiatives focused on the social dynamic of sustainability. In 2022, we:

Invested in Groendus, a Dutch energy transition firm active in rooftop solar, metering and energy services.

Joined other institutional investors in funding Group14 Technologies, an innovative electric battery materials manufacturer.

Led a funding round for 99 Counties, a US-based platform that supports regenerative farming that brings sustainable products to market and offers healthy, nutrient-dense foods to consumers.

Increased our support for NovaSource Power Services, the world’s largest independent solar operations and maintenance provider for utility-scale, commercial, industrial, and residential solar assets.

Established a partnership to explore North American investments that address sustainability in sectors including food, water, energy, transport, and waste.

Broke ground on one of North America’s largest housing co-operative renewal projects, a multifamily development in South Vancouver that will help address the local housing choice and supply crisis by adding a significant source of purpose-built rental supply into the community, more than doubling the existing number of housing co-operative units on site.

Received approval on a new mixed-use commercial building in Boston that, among its benefits, will increase access to affordable housing and improve community connections.

Tech-Forward Innovation

We are investing in businesses doing interesting work to innovate, harnessing the power of technology to do so. During 2022, we:

Partnered to provide a term loan to AGP, a highly specialized glass manufacturer with advanced technology for autonomous vehicles and producer of specialty automotive glazing components, to support its global expansion plans.

Led the funding rounds in exciting businesses including Moves, an all-in-one banking app for gig workers, and Altana, a startup using AI to sift through data points across the supply chain to spot anomalies and identify potential risks.

Communications and Business Services

We invest in companies that provide important tools for individuals, communities and organizations. These range from utilities and infrastructure that provide vital connections to services that support efficient business operations. In 2002, we:

Purchased TPG Telecom's mobile towers and rooftop portfolio, located across Australia; and Stilmark, an independent developer, owner and operator of Australian mobile tower assets. These acquisitions were subsequently combined to operate as a single business under a new brand, Waveconn.

Invested in Network Plus, a leading utility and infrastructure repair and maintenance service provider in the UK, that maintains and delivers essential services – including water, electricity, gas and telecoms – to homes, businesses, and industry.

Acquired Pueblo Mechanical & Controls, a leading mechanical services company providing HVAC and plumbing installation, retrofit and repair services to commercial clients, based in Arizona (US).

Led funding for Fairmarkit, an AI-enabled procurement platform built to efficiently source lower-dollar, non-strategic purchases; Joyn Insurance who are using technology to provide coverage for small to mid-sized businesses; and Falkon AI, a data-insights company providing reporting, analysis and automated recommendations to businesses clients.

Deploying into Private Credit

For a number of years, we have been steadily building out our private credit investing expertise, platform and relationships. In 2022, we took advantage of the rising interest rate environment to strategically deploy capital into high-quality short-term credit, pleased that the risk-adjusted returns continue to present a compelling opportunity.

Realizations

We rotate capital out of assets with the same level of discipline with which we invest. This activity generates capital, which we deploy into future investment opportunities that align to our strategy. In 2022, we completed the following realizations:

Straight Crossing Development Inc., which operates the Confederation Bridge, a Canadian landmark connecting the provinces of New Brunswick and Prince Edward Island.

GNL Quintero S.A., a liquid natural gas terminal in Chile.

Forefront Dermatology, a consolidated dermatology clinic business. As part of the transaction, we reinvested with a minority stake.

A 50% interest in the Sony Centre, an office-led mixed-use landmark property in Berlin. R

Royal Bank Plaza in Toronto’s financial district and St. John’s Terminal in Manhattan; each representing one of the largest office transactions of the year in their respective markets.

The Plan’s interest in the holding company that controls the Michigan-based Midland Cogeneration Venture (MCV), a gas-fired cogeneration facility.

The sale of our investment in Skyway Concession Company LLC, which manages, operates and maintains the Chicago Skyway toll road.

In addition to the above completed transactions, we announced the sale of a majority stake in Trescal, the global leader in calibration services. We have announced a reinvestment as part of the transaction, retaining a minority stake.

Funded Status Update

After almost a decade of reporting a progressively stronger funded position (from 86% in 2012 to 97% in 2021) – measured with an increasingly lower real discount rate – our funded ratio dipped to 95% at December 31, 2022, as measured on a “smoothed” basis, averaging our investment returns over five years. The funded ratio is a measure of OMERS assets to OMERS pension liabilities.

The largest reason for this decline was the impact of Canada’s historically high rate of price inflation. For payments made in 2023, OMERS retirees received a 6% increase to their annual pension payments due to inflation indexation. This rate is well above our 2% long-term assumption for inflation, which is the target rate for the Bank of Canada.