Contributions to an AVC account receive the same net investment returns as the OMERS Fund (the Fund). AVCs returned 8.3% in 2024.

All working (including members on disability waiver), deferred and retired members can transfer money from other registered retirement savings vehicles such as RRSPs to an AVC account during the annual AVC transfer-in window. The AVC transfer-in window is from January 1 to June 30 of each year, until the year you turn age 70. Working members can also contribute regularly, from as low as $40 per month, via pre-authorized debit or payroll deduction if your employer offers the AVC payroll deduction option.

Depending on whether you are a working or retired member, you have several AVC withdrawal options.

To learn more about how the net rate of return is applied to your account, check out our Rate of return examples.

The AVC option is only available to members who reside in Canada.

The AVC option is available exclusively to members of the OMERS Plan to age 70. This includes:

Working members, including members on disability waiver

Retired members

Members who left their OMERS employer but kept their pension in the Plan (deferred members)

AVCs offer another option to build additional retirement savings. However, the AVC option is voluntary and may not be right for everyone's retirement savings plans or life stage. What is most important is that you know your options and decide what is best for you.

AVCs are likely most suitable for members with:

Interest in investing in a balanced, diversified global fund

Mid-to-long-term investment horizon (five to 15 years)

Moderate risk tolerance (The Fund has an annual average rate of return of 7.3% over the last 10 years, but there is potential for negative return (loss) in any given year)

Ability to commit to and maintain automatic contributions for the long term

An AVC account is an option available exclusively to OMERS members, but it may not fit everyone’s investment plan, risk tolerance, cash-flow situation or stage of life.

You need to sign in to myOMERS to set up an AVC account. If you don't have a myOMERS account, creating one is easy! All you need is your email address or phone number and date of birth.

AVCs are part of the Plan, but separate from your defined benefit pension.

These contributions are credited with the Fund’s net rate of return for the calendar year, prorated to reflect when the deposit was made. This means that the rate of return that will be credited on your contributions is determined by the performance of the Fund over the course of the full year, not just from the point when your deposit was made.

There are two ways to contribute to an AVC account:

The fund transfer option is available to all members during the annual AVC transfer-in window from January 1 to June 30 of each year, until the year you turn 70. Fund transfers to your AVC account may come from an RRSP, a locked-in retirement account (LIRA) or other registered retirement vehicles.

Automatic contributions are available if you are a working member, including if you are on a disability waiver. They're easy to set up and:

Are automatically withdrawn via pre-authorized debit or payroll deduction if your employer offers the AVC payroll deduction option.*

Are subject to minimum and maximum contribution limits established by OMERS

Are tax-deductible in the year they are made.

When deciding on how much, and how often, you wish to contribute, note that the $35 annual administration is not prorated and the full amount applies to your account regardless of the number of months contributed for the year. Keep this in mind when considering the amount, start date and frequency of your automatic contributions.

*OMERS employers can choose to offer the AVC payroll deduction option.

Members making automatic contributions can make a payment to catch up on their automatic contributions for the year.

You may be able to make a catch-up payment if:

you started automatic contributions partway through the year; or

you’ve been contributing less than your biweekly or monthly maximum.

Catch-up payments can be made online through myOMERS or by completing a paper form (AVC Catch-up Payments - Form 406).

Contribution limits are based on contributory earnings and credited service, and take into account the pension adjustment (PA) reporting rules of the Income Tax Act.

Contributory earnings | Biweekly maximum 26 debits per year | Monthly maximum 12 debits per year |

|---|---|---|

Less than $4,445.00 | - | - |

$4,445.00 - $11,522.00 | $20.00 | $40.00 |

$11,523.00 - $19,749.00 | $38.46 | $83.33 |

$19,750.00 - $27,983.00 | $57.69 | $125.00 |

$27,984.00 - $36,211.00 | $76.92 | $166.67 |

$36,212.00 - $44,444.00 | $96.15 | $208.33 |

$44,445.00 - $169,517.80 | $115.38 | $250.00 |

Over $169,517.80 | $20.00 | $40.00 |

The limits were calculated using the 2025 year's maximum pensionable earnings (YMPE).

For information on your withdrawal options, see this page.

The following examples show how the rate of return for the Plan is applied to a member’s AVC account in six different scenarios.

The first five scenarios show how the rate of return is applied in the normal course, which is:

The rate of return for the Plan is established on or around March 1 each year – this is the rate determination date for AVC purposes.

After the rate determination date, the annual rate of return, less investment management expenses and the annual AVC administration fee, are applied to a member’s AVC account.

The rate of return is applied on a prorated basis to any amounts that are held in a member’s AVC account for part of the year.

The last two scenarios show differences in how the rate of return is applied when a member elects to withdraw their entire AVC account balance (e.g., on termination of employment or retirement).

Specifically, these scenarios show differences in how the rate of return is applied depending on whether the member’s AVC withdrawal forms are received by OMERS before or after the rate determination date.

For more details and definitions for the annual rate of return, five-year average rate of return and rate determination date, please see the Terms of Participation.

Scenario | How the rate of return is applied |

|---|---|

Scenario 1 | No contributions or withdrawals |

Scenario 2 | Lump-sum transfer |

Scenario 3 | Partial withdrawal |

Scenario 4 | Year member opens an AVC account |

Scenario 5 | Negative rate of return |

Scenario 6 | Full withdrawal (documents received after the rate determination date) |

Scenario 7 | Full withdrawal (documents received before the rate determination date) |

Note: All figures are for illustrative purposes only and do not reflect past or future returns or expenses. Results are rounded to the nearest dollar for illustrative purposes.

Rate of Return Examples

Bob did not make any contributions to or withdrawals from his AVC account during 2030. Once the 2030 rate of return is established on or around March 1, 2031, Bob’s account will be updated for 2030 as follows.

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

2030 annual rate of return | 7.5% |

2030 investment management expenses | 0.5% |

Net rate of return applied to Bob’s AVC account | 7% |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Plus net rate of return (7% applied to $100,000) | +$7,000 |

Less administration fee | -$35 |

AVC account balance as at December 31, 2030 | $106,965 |

RATE OF RETURN EXAMPLES

Bob makes a lump-sum transfer into his AVC account during 2030. Once the 2030 rate of return is established on or around March 1, 2031, Bob’s account will be updated for 2030 as follows.

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Lump-sum transfer on March 31, 2030 | $25,000 |

2030 annual rate of return | 7.5% |

2030 investment management expenses | 0.5% |

Net rate of return applied to Bob’s AVC account | 7% |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Plus non-prorated net rate of return (7% applied to $100,000) | +$7,000 |

Plus lump-sum transfer on March 31 | +$25,000 |

Plus prorated net rate of return (7% applied to $25,000 for 9 months of the year) | +$1,312 |

Less administration fee | -$35 |

AVC account balance as at December 31, 2030 | $133,277 |

RATE OF RETURN EXAMPLES

Bob makes a withdrawal from his AVC account during 2030. Once the 2030 rate of return is established on or around March 1, 2031, Bob’s account will be updated for 2030 as follows:

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Withdrawal on March 31, 2030 | $10,000 |

2030 annual rate of return | 7.5% |

2030 investment management expenses | 0.5% |

Net rate of return applied to Bob’s AVC account | 7% |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Less withdrawal on March 31 | -$10,000 |

Plus non-prorated net rate of return (7% applied to $90,000) | +$6,300 |

Plus prorated net rate of return (7% applied to $10,000 for 3 months of the year) | +$175 |

RATE OF RETURN EXAMPLES

Bob opens an AVC account on March 30, 2030. Once the 2030 rate of return is established on or around March 1, 2031, Bob’s account will be updated for 2030 as follows.

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $0 |

Lump-sum transfer-in on March 31, 2030 | $2,000 |

2030 annual rate of return | 7.5% |

2030 investment management expenses | 0.5% |

Net rate of return applied to Bob’s AVC account | 7% |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

Lump-sum transfer-in on March 31 | +$2,000 |

Plus prorated net rate of return (7% applied to $2,000 for 9 months of the year) | +$105 |

Less administration fee | -$35 |

AVC account balance as at December 31, 2030 | $2,070 |

RATE OF RETURN EXAMPLES

Bob did not make any contributions or withdrawals to his AVC account during 2030. Once the 2030 rate of return is established on or around March 1, 2031, Bob’s account will be updated for 2030 as follows:

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

2030 annual rate of return | -1.5% |

2030 investment management expenses | 0.5% |

Net rate of return applied to Bob’s AVC account | -2% |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Plus non-prorated net rate of return (-2.0% applied to $100,000) | -$2,000 |

Less administration fee | -$35 |

AVC account balance as at December 31, 2030 | $97,965 |

RATE OF RETURN EXAMPLES

Bob is retiring from his OMERS employer and has decided to withdraw 100% of the funds in his AVC account upon retirement. OMERS receives his AVC withdrawal form in September 2030. The rate determination date for 2029 was March 1, 2030.

Since Bob returned his AVC withdrawal form after the rate determination date for 2029, Bob’s AVC account balance to December 31, 2029 has already been updated with the annual rate of return for 2029, less investment management expenses and the AVC administration fee for 2029.

For 2030, Bob’s AVC account balance as at December 31, 2029 is updated with the five-year average rate of return, less investment management expenses, and the AVC administration fee for 2030 – to the date his AVC account is paid out in 2030.

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Five-year average net rate of return for 2025, 2026, 2027, 2028 and 2029 | 7% |

Date Bob’s account is paid out | September 30, 2030 |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Plus pro rated five-year average net rate of return (7% applied to $100,000 for 9 months of the year) | +$5,250 |

Less administration fee for 2030 | -$35 |

AVC account balance on date account is paid out | $105,215 |

RATE OF RETURN EXAMPLES

Bob terminates employment with his OMERS employer and has decided to withdraw 100% of the funds in his AVC account upon retirement. OMERS receives his AVC withdrawal form in January 2030. The rate determination date for 2029 will be on or around March 1, 2030.

Since Bob returned his AVC withdrawal form before the rate determination date, Bob’s AVC account balance to December 31, 2028 will first be updated to December 31, 2029 with the five-year average rate of return, less investment management expenses, and the AVC administration fee for 2029.

For 2030, Bob’s updated AVC account balance as at December 31, 2029 is updated using the same five-year average rate of return, less investment management expenses, and the AVC administration fee for 2030 – to the date his AVC account is paid out in 2030.

Assumptions | |

|---|---|

Account balance as at December 31, 2028 | $100,000 |

Five-year average net rate of return for 2024, 2025, 2026, 2027 and 2028 | 7% |

Date Bob’s account is paid out | January 31, 2030 |

First, Bob’s account is updated to December 31, 2029 | |

|---|---|

AVC account balance as at December 31, 2028 | $100,000 |

Plus five-year average net rate of return (7% applied to $100,000) | +$7,000 |

Less administration fee for 2029 | -$35 |

AVC account balance as at December 31, 2029 | $106,965 |

Then, Bob’s account is updated to January 31, 2030 (date funds withdrawn) | |

|---|---|

AVC account balance as at December 31, 2029 | $106,965 |

Plus prorated five-year average net rate of return (7% applied to $106,965 for one month of the year) | +$624 |

Less administration fee for 2030 | -$35 |

AVC account balance on date account is paid out | $107,554 |

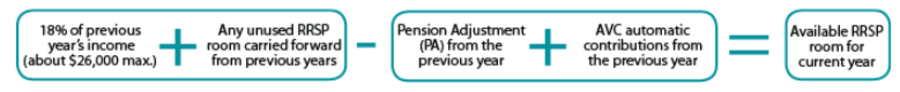

The amount you can contribute to your RRSP in any year – your RRSP “room” – is calculated as follows:

Pension Adjustment (PA) – The PA puts a value on the benefit you earned in OMERS for the year and it reduces the amount you can contribute to RRSPs in the following year. So, your 2023 PA reduces your available RRSP room in 2024. Your PA is shown in Box 52 of your T4 slip or Box 34 of your T4A slip.

AVC automatic contributions – Like your PA, AVC automatic contributions reduce the amount you can contribute to RRSPs in the following year. AVC automatic contributions are made by pre-authorized debit or employer payroll deductions. AVC contributions made by pre-authorized debit are included in the PA in Box 34 of your T4A tax slip whereas employer payroll deductions are included in the PA in Box 52 of your T4 tax slip. Funds coming into an AVC account from a registered retirement vehicle (e.g., RRSP) are already tax sheltered and don’t affect RRSP room.

About the OMERS member:

18% of 2023 income: $13,000

Unused room carried forward from previous years: $0

PA on the 2023 T4 slip: $10,000

Contributions to AVCs by pre-authorized debit in 2023: $2,000

The member’s RRSP room is calculated as follows:

OMERS AVC automatic contribution limits – To reduce the likelihood of members over-contributing to an RRSP, we’ve established automatic contribution limits. These limits are based on earnings and credited service and take into account the PA rules. For more on how the limits work, see page 10 the AVC Guide. The limit does not apply to transfers from a registered retirement vehicle because the funds are already tax sheltered – i.e., there is no minimum or maximum for fund transfers to an AVC account.

Another member begins making AVC automatic contributions in 2023 and wants to contribute up to the AVC limit. The member’s available RRSP room for 2023 is $4,000 after accounting for OMERS PA from the previous year. In 2023, the member can make $4,000 in RRSP contributions (in addition to any unused room carried forward from previous years) plus $3,000 in AVC contributions, which is the automatic contribution limit based on the member’s earnings and credited service, for a total tax-deductible contribution of $7,000.

In 2024, the member’s available RRSP room is $1,000 after accounting for OMERS PA and AVC automatic contributions from the previous year. The member can make $1,000 in RRSP contributions (again, in addition to any unused room carried forward from previous years) plus $3,000 in AVC contributions for a total tax-deductible contribution of $4,000 for 2024.

18% of annual income | PA on T4 tax slip | AVC automatic contribution limit for current year | Available RRSP room for following year – after OMERS PA & AVCs | RRSP room (max. RRSPs in current year) | Max. RRSPs and AVCs in current year | |

|---|---|---|---|---|---|---|

2022 | $16,000 | $12,000 | $16,000 – $12,000 = $4,000 |

In 2023, the member begins making AVC contributions by pre-authorized debit and contributes up to the AVC limit.

18% of annual income | PA on T4 tax slip | AVC automatic contribution limit for current year | Available RRSP room for following year – after OMERS PA & AVCs | RRSP room (max. RRSPs in current year) | Max. RRSPs and AVCs in current year | |

|---|---|---|---|---|---|---|

2023 | $17,000 | $13,000 | $3,000 | $17,000 – (13,000 + $3,000) = $1,000 | $4,000 | $3,000 + $4,000 = $7,000 |

2024 | $18,000 | $14,000 | $3,000 | $18,000 – ($14,000 + $3,000) = $1,000 | $1,000 | $3,000 + $1,000 = $4,000 |

Note: All figures are for illustrative purposes only.

Set up your AVC account online through myOMERS, which also gives you safe and secure access to your personal pension information. To get started, log in to myOMERS.

Not registered yet? Registering for myOMERS is quick and easy, and comes with many more benefits in addition to AVC account set-up. With myOMERS, you can get a complete overview of your pension, designate or update your beneficiaries, estimate your retirement income and more!

Complete the AVC registration form (Form 401) to start, modify or stop automatic contributions to your AVC account. Use the AVC transfer package (Form 402) to transfer funds to your AVC account during the AVC transfer-in window from January 1 to June 30 of each year, until the year you turn age 70.

Explore the different options for withdrawing funds from your AVC account.

Learn how purchasing past service from a previous or current employer can help increase your pension.

If you return from a leave, you may be able to purchase that leave to add to your OMERS credited service.