Contributions to an AVC account receive the same net investment returns as the Fund. AVCs returned 4.6% in 2023.

All members can transfer money from other registered retirement savings vehicles such as RRSPs to an AVC account during the annual AVC transfer-in window from January 1 to June 30 of each year, until the year they turn age 70. Active members can also contribute regularly, from as low as $40 per month, via pre-authorized debit or payroll deduction if your employer offers the AVC payroll deduction option. These contributions are credited with the Fund’s net rate of return for the calendar year, prorated to reflect when the deposit was made. This means that the rate of return that will be credited on your contributions is determined by the performance of the Fund over the course of the full year, not just from the point when your deposit was made.

To learn more about how the net rate of return is applied to your account, check out our Rate of Return examples.

The AVC option is only available to members who reside in Canada.

The Additional Voluntary Contributions (AVCs) option is a retirement savings and investment opportunity.

AVCs are similar in some ways to registered retirement savings arrangements, but they are part of the OMERS Primary Pension Plan (OMERS Plan). AVCs enable members to participate in the OMERS Fund.

The idea for AVCs grew from requests by members to make additional investments with OMERS. An AVC account is in addition to your OMERS pension.

Since AVCs are part of the OMERS Plan (a registered pension plan), your AVC account balance is allowed to grow tax-deferred. Automatic contributions to an AVC account are tax-deductible in the year they are made.

The AVC option is available exclusively to members of the OMERS Plan to age 70. This includes:

Active members

Retired members

Members who left their OMERS employer but kept their pension in the OMERS Plan (deferred members)

At OMERS, we believe AVCs offer another option to build additional retirement savings. However, what we believe is not as important as what you decide is best for you. The AVC option is voluntary and may not be right for everyone's retirement savings plans or life stage.

AVCs are likely most suitable for members with:

Interest in investing in a balanced, diversified global fund

Mid-to-long-term investment horizon (five to 15 years)

Moderate risk tolerance (OMERS Fund has an annual average rate of return of 7.3% over the last 10 years, but there is potential for negative return (loss) in any given year).

Adequate cash flow

An AVC account is an option available exclusively to OMERS members, but it may not fit everyone’s investment plan, risk tolerance, cash-flow situation or stage of life.

AVCs are part of the OMERS Primary Pension Plan, but are separate from your defined benefit pension.

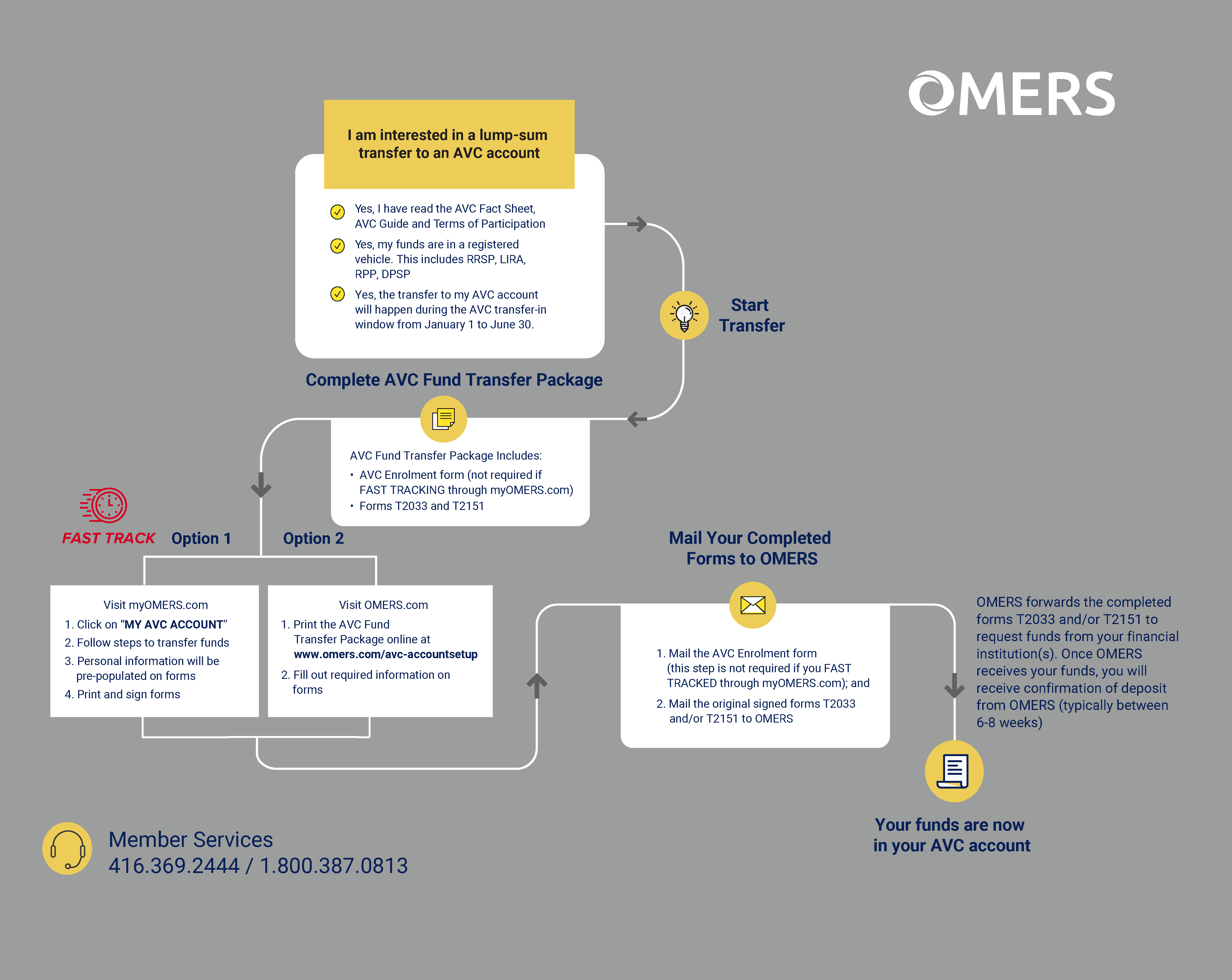

The fund transfer option is available to all OMERS members during the annual AVC transfer-in window from January 1 to June 30 of each year, until the year they turn 70. Fund transfers to your AVC account may come from an RRSP, a locked-in retirement account (LIRA) or other registered retirement vehicles.

Automatic contributions are available to you if you are an active member. They're easy to set up, and:

Are automatically withdrawn via pre-authorized debit or payroll deduction if your employer offers the AVC payroll deduction option.*

Are subject to minimum and maximum contribution limits established by OMERS

Are tax-deductible in the year they are made.

When deciding on how much, and how often, you wish to contribute, please remember that the $35 annual administration is not prorated and the full amount applies to your account regardless of the number of months contributed for the year. Keep this in mind when considering the amount, start date and frequency of your automatic contributions. *OMERS employers can choose to offer the AVC payroll deduction option.

Members making automatic contributions can make a payment to catch up on their automatic contributions for the year.

You may be able to make a catch-up payment if:

you started automatic contributions partway through the year; or

you’ve been contributing less than your biweekly or monthly maximum.

Ready to make a catch-up payment? Catch-up payments can be made online through myOMERS or by completing a paper form (AVC Catch-up Payments - Form 406).

Contribution limits are based on contributory earnings credited service, and take into account the pension adjustment (PA) reporting rules of the Income Tax Act.

Contributory Earnings | Biweekly Maximum 26 Debits per Year | Monthly Maximum 12 Debits per Year |

|---|---|---|

Less than $4,444.00 | - | - |

$4,445.00 - $11,522.00 | $20.00 | $40.00 |

$11,523.00 - $19,749.00 | $38.46 | $83.33 |

$19,750.00 - $27,983.00 | $57.69 | $125.00 |

$27,984.00 - $36,211.00 | $76.92 | $166.67 |

$36,212.00 - $44,444.00 | $96.15 | $208.33 |

$44,445.00 - $162,895.00 | $115.38 | $250.00 |

Over $162,895.00 | $20.00 | $40.00 |

The limits were calculated using the 2024 year's maximum pensionable earnings (YMPE).

Maximum 20% of the prior year-end AVC account balance subject to a minimum of $500.

If partial withdrawals are made in each of four consecutive years, the 20% limit does not apply in the fifth consecutive year. In the fifth year, you can withdraw up to your entire account balance (excluding current year contributions).

March 1 to April 30

Can be taken as cash, less withholding tax, or transferred tax-deferred to an RRSP, a registered retirement income fund (RRIF) or another registered pension plan.

Can be transferred only to a locked-in arrangement, such as a LIRA or a locked-in provision under a registered pension plan.

You may withdraw all or some of the funds in your AVC account at any time within the first 6 months after retirement, or upon leaving your OMERS employer if you keep your pension with OMERS*. After that, you can withdraw all or some of the funds during the March/April window.

Withdrawals are subject to a minimum of $500.

Non-locked-in funds in your AVC account may be withdrawn as cash, less withholding tax.

Up to the year you turn 71, non-locked-in and locked-in funds in your AVC account may be transferred to another registered retirement savings vehicle, tax-deferred, or used to purchase an annuity.

You can keep the funds in your AVC account.

Non-locked-in funds can remain in your account past the year you turn 71 through the AVC Income Option.

The full balance of locked-in funds must be withdrawn by October 31 of the year your turn 71.

*If you leave your OMERS employer and transfer your defined benefit pension out of OMERS, you must withdraw the full balance of your AVC account.

If you no longer have an accompanying benefit under the OMERS Plan, you cannot continue your AVC account. You must withdraw or transfer the full balance of your AVC account:

if you terminate your membership in the defined benefit provision of the OMERS Plan and transfer out the commuted value of your pension

if you use the shortened life expectancy provision of the OMERS Plan

In addition, you must withdraw or transfer the full balance of any locked-in funds by October of the year you turn 71.

In the event of your death before or after retirement, your surviving spouse is entitled to a refund of your AVC account balance, provided you were not living separate and apart on the date of your death, and your surviving spouse did not waive his or her entitlement.

If you don’t have a spouse, the refund will be paid to your designated beneficiary(ies) on file with OMERS. If you don’t have a spouse or designated beneficiary(ies), the refund will be paid to your estate.

For more information on this process, consult the Terms of Participation on the right.

There are two ways to withdraw funds from your AVC account:

If you choose the paper withdrawal option, be sure to complete the correct form below. In the year you turn 71 and beyond, you will have to use the paper form. You will not be able to initiate your withdrawal using myOMERS.

Use this form to withdraw funds from your AVC account if you are an active member.

Use this form to withdraw funds from your AVC account if you are a retired or deferred member and you have not yet turned age 72.

To make an optional withdrawal during the annual March 1 to April 30 withdrawal window, you will need to use the paper form. You will not be able to initiate your withdrawal using myOMERS.

Use this form if you participate in the AVC Income Option and wish to make an optional withdrawal from your AVC account.

The following examples show how the rate of return for the OMERS Primary Pension Plan (OMERS Plan) is applied to a member’s AVC account in six different scenarios.

The first five scenarios show how the rate of return is applied in the normal course, which is:

The rate of return for the OMERS Plan is established on or around March 1st each year – this is the rate determination date for AVC purposes.

After the rate determination date, the annual rate of return, less investment management expenses and the annual AVC administration fee, are applied to a member’s AVC account.

The rate of return is applied on a pro-rated basis to any amounts that are held in a member’s AVC account for part of the year.

The last two scenarios show differences in how the rate of return is applied when a member elects to withdraw his or her entire AVC account balance (e.g., on termination of employment or retirement).

Specifically, these scenarios show differences in how the rate of return is applied depending on whether the member’s AVC withdrawal forms are received by OMERS before or after the rate determination date.

For more details, and for the definitions of the “annual rate of return,” the “five year average rate of return” and “rate determination date,” please see the Terms of Participation.

Scenario 1: No contributions or withdrawals

Scenario 2: Lump-sum transfer

Scenario 3: Partial withdrawal

Scenario 4: Year member opens an AVC account

Scenario 5: Negative rate of return

Scenario 6: Full withdrawal

(documents received after the rate determination date)

Scenario 7: Full withdrawal

(documents received before the rate determination date)

Note: All figures are for illustrative purposes only and do not reflect past or future returns or expenses. Results are rounded to the nearest dollar for illustrative purposes.

Rate of Return Examples

Bob did not make any contributions to or withdrawals from his AVC account during 2030. Once the 2030 rate of return is established on or around March 1, 2031, Bob’s account will be updated for 2030 as follows.

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

2030 annual rate of return | 7.5% |

2030 investment management expenses | 0.5% |

Net rate of return applied to Bob’s AVC account | 7% |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Plus net rate of return (7% applied to $100,000) | +$7,000 |

Less administration fee | -$35 |

AVC account balance as at December 31, 2030 | $106,965 |

RATE OF RETURN EXAMPLES

Bob did not make any contributions to or withdrawals from his AVC account during 2030. Once the 2030 rate of return is established on or around March 1, 2031, Bob’s account will be updated for 2030 as follows.

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Lump-sum transfer on March 31, 2030 | $25,000 |

2030 annual rate of return | 7.5% |

2030 investment management expenses | 0.5% |

Net rate of return applied to Bob’s AVC account | 7% |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Plus non-pro-rated net rate of return (7% applied to $100,000) | +$7,000 |

Plus lump-sum transfer on March 31 | +$25,000 |

Plus pro-rated net rate of return (7% applied to $25,000 for 9 months of the year) | +$1,312 |

Less administration fee | -$35 |

AVC account balance as at December 31, 2030 | $133,277 |

RATE OF RETURN EXAMPLES

Bob makes a withdrawal from his AVC account during 2030. Once the 2030 rate of return is established on or around March 1, 2031, Bob’s account will be updated for 2030 as follows:

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Withdrawal on March 31, 2030 | $10,000 |

2030 annual rate of return | 7.5% |

2030 investment management expenses | 0.5% |

Net rate of return applied to Bob’s AVC account | 7% |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Less withdrawal on March 31 | -$10,000 |

Plus non-pro-rated net rate of return (7% applied to $90,000) | +$6,300 |

Plus pro-rated net rate of return (7% applied to $10,000 for 3 months of the year) | +$175 |

RATE OF RETURN EXAMPLES

Bob opens an AVC account on March 30, 2030. Once the 2030 rate of return is established on or around March 1, 2031, Bob’s account will be updated for 2030 as follows.

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $0 |

Lump-sum transfer-in on March 31, 2030 | $2,000 |

2030 annual rate of return | 7.5% |

2030 investment management expenses | 0.5% |

Net rate of return applied to Bob’s AVC account | 7% |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

Lump-sum transfer-in on March 31 | +$2,000 |

Plus pro-rated net rate of return (7% applied to $2,000 for 9 months of the year) | +$105 |

Less administration fee | -$35 |

AVC account balance as at December 31, 2030 | $2,070 |

RATE OF RETURN EXAMPLES

Bob did not make any contributions or withdrawals to his AVC account during 2030. Once the 2030 rate of return is established on or around March 1, 2031, Bob’s account will be updated for 2030 as follows:

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

2030 annual rate of return | -1.5% |

2030 investment management expenses | 0.5% |

Net rate of return applied to Bob’s AVC account | -2% |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Plus non-pro-rated net rate of return (-2.0% applied to $100,000) | -$2,000 |

Less administration fee | -$35 |

AVC account balance as at December 31, 2030 | $97,965 |

RATE OF RETURN EXAMPLES

Bob is retiring from his OMERS employer and has decided to withdraw 100% of the funds in his AVC account upon retirement. OMERS receives his AVC withdrawal form in September 2030. The rate determination date for 2029 was March 1, 2030.

Since Bob returned his AVC withdrawal form after the rate determination date for 2029, Bob’s AVC account balance to December 31, 2029 has already been updated with the annual rate of return for 2029, less investment management expenses and the AVC administration fee for 2029.

For 2030, Bob’s AVC account balance as at December 31, 2029 is updated with the five-year average rate of return, less investment management expenses, and the AVC administration fee for 2030 – to the date his AVC account is paid out in 2030.

Assumptions | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Five-year average net rate of return for 2025, 2026, 2027, 2028 and 2029 | 7% |

Date Bob’s account is paid out | September 30, 2030 |

How the rate of return is applied to Bob’s AVC account | |

|---|---|

AVC account balance as at December 31, 2029 | $100,000 |

Plus pro-rated five-year average net rate of return (7% applied to $100,000 for 9 months of the year) | +$5,250 |

Less administration fee for 2030 | -$35 |

AVC account balance on date account is paid out | $105,215 |

RATE OF RETURN EXAMPLES

Bob terminates employment with his OMERS employer and has decided to withdraw 100% of the funds in his AVC account upon retirement. OMERS receives his AVC withdrawal form in January 2030. The rate determination date for 2029 will be on or around March 1, 2030.

Since Bob returned his AVC withdrawal form before the rate determination date, Bob’s AVC account balance to December 31, 2028 will first be updated to December 31, 2029 with the five-year average rate of return, less investment management expenses, and the AVC administration fee for 2029.

For 2030, Bob’s updated AVC account balance as at December 31, 2029 is updated using the same five-year average rate of return, less investment management expenses, and the AVC administration fee for 2030 – to the date his AVC account in paid out in 2030.

Assumptions | |

|---|---|

Account balance as at December 31, 2028 | $100,000 |

Five-year average net rate of return for 2024, 2025, 2026, 2027 and 2028 | 7% |

Date Bob’s account is paid out | January 31, 2030 |

First, Bob’s account is updated to December 31, 2029 | |

|---|---|

AVC account balance as at December 31, 2028 | $100,000 |

Plus five-year average net rate of return (7% applied to $100,000) | +$7,000 |

Less administration fee for 2029 | -$35 |

AVC account balance as at December 31, 2029 | $106,965 |

Then, Bob’s account is updated to January 31, 2030 (date funds withdrawn) | |

|---|---|

AVC account balance as at December 31, 2029 | $106,965 |

Plus pro-rated five-year average net rate of return (7% applied to $106,965 for one month of the year) | +$624 |

Less administration fee for 2030 | -$35 |

AVC account balance on date account is paid out | $107,554 |

The amount you can contribute to your RRSP in any year – your RRSP “room” – is calculated as follows:

Pension Adjustment (PA) – The PA puts a value on the benefit you earned in OMERS for the year and it reduces the amount you can contribute to RRSPs in the following year. So, your 2017 PA reduces your available RRSP room in 2018. Your employer reports your PA in Box 20 of your T4 tax slip.

AVC automatic contributions – Like your PA, AVC automatic contributions reduce the amount you can contribute to RRSPs in the following year. AVC automatic contributions are made by pre-authorized debit or employer payroll deductions. Employer payroll deductions are included in the PA in Box 20 of your T4 tax slip. Funds coming into an AVC account from a registered retirement vehicle (e.g., RRSP) are already tax sheltered and don’t affect RRSP room.

About the OMERS member:

18% of 2017 income: $13,000

Unused room carried forward from previous years: $0

PA on the 2017 T4 slip: $10,000

Contributions to AVCs by pre-authorized debit in 2017: $2,000

The member’s RRSP room is calculated as follows:

OMERS AVC Automatic Contribution Limits – To reduce the likelihood of members over-contributing to an RRSP, we’ve established automatic contribution limits. These limits are based on earnings and credited service and take into account the PA rules. For more on how the limits work, see page 10 the AVC Guide. The limit does not apply to transfers from a registered retirement vehicle because the funds are already tax sheltered – i.e., there is no minimum or maximum for fund transfers to an AVC account.

Another member begins making AVC automatic contributions in 2017 and wants to contribute up to the AVC limit. The member’s available RRSP room for 2017 is $4,000 after accounting for OMERS PA from the previous year. In 2017, the member can make $4,000 in RRSP contributions (in addition to any unused room carried forward from previous years) plus $3,000 in AVC contributions, which is the automatic contribution limit based on the member’s earnings and credited service, for a total tax-deductible contribution of $7,000.

In 2018, the member’s available RRSP room is $1,000 after accounting for OMERS PA and AVC automatic contributions from the previous year. The member can make $1,000 in RRSP contributions (again, in addition to any unused room carried forward from previous years) plus $3,000 in AVC contributions for a total tax-deductible contribution of $4,000 for 2018.

18% of annual income | PA on T4 tax slip | AVC automatic contribution limit for current year | Available RRSP room for following year – after OMERS PA & AVCs | RRSP room (max. RRSPs in current year) | Max. RRSPs and AVCs in current year | |

|---|---|---|---|---|---|---|

2016 | $16,000 | $12,000 | $16,000 – $12,000 = $4,000 |

In 2017, the member begins making AVC contributions by pre-authorized debit and contributes up to the AVC limit.

2017 | $17,000 | $13,000 | $3,000 | $17,000 – (13,000 + $3,000) = $1,000 | $4,000 | $3,000 + $4,000 = $7,000 |

2018 | $18,000 | $14,000 | $3,000 | $18,000 – ($14,000 + $3,000) = $1,000 | $1,000 | $3,000 + $1,000 = $4,000 |

Note: All figures are for illustrative purposes only

In response to requests from members, we've introduced an option to keep non-locked-in funds in your AVC account beyond the year in which you turn age 71. We call this new part of the AVC program the "AVC Income Option."

The AVC Income Option brings three important changes to AVCs:

You are no longer required to transfer non-locked-in funds out of your AVC account by the end of the year in which you turn age 71. Any non-locked-in funds that you have in your AVC account on December 31st of the year you turn age 71 will remain in your AVC account, and your participation in OMERS AVCs will continue.

You must withdraw a minimum amount each year starting with the year you turn age 72. This withdrawal, which we call the "income amount," is required under the Income Tax Act and must be paid in cash.

Optional withdrawals during the withdrawal window must be made in cash after the year you turn age 71. Fund transfers to another savings arrangement are no longer available.

Aside from these changes, the same features of OMERS AVCs continue to apply, such as the application of the OMERS Fund rate of return and the ability to make optional withdrawals during the withdrawal window.

If you have non-locked-in funds in your AVC account on December 31st of the year you turn age 71, the funds will remain in your AVC account and your participation in OMERS AVCs will continue. With the AVC Income Option, you can keep funds in your AVC account for your lifetime, provided you withdraw at least the minimum each year.

Each year after you turn age 71, you must withdraw at least the income amount from your AVC account.

The income amount starts at around 5% of your AVC account balance at age 72, and peaks at 20% at age 95 and beyond. The age-based percentage is applied to the balance of your AVC account at the start of the year. The income amount is calculated using the formula set out in the Income Tax Act, and will be shown on your AVC Annual Statement, which is mailed to you at the end of February each year.

Your age on January 1 | % of your AVC account that must be withdrawn in that year |

|---|---|

71 | 5.28 |

72 | 5.4 |

73 | 5.53 |

74 | 5.67 |

75 | 5.82 |

76 | 5.98 |

77 | 6.17 |

78 | 6.36 |

Your age on January 1 | % of your AVC account that must be withdrawn in that year |

|---|---|

79 | 6.58 |

80 | 6.82 |

81 | 7.08 |

82 | 7.38 |

83 | 7.71 |

84 | 8.08 |

85 | 8.51 |

86 | 8.99 |

Your age on January 1 | % of your AVC account that must be withdrawn in that year |

|---|---|

87 | 9.55 |

88 | 10.21 |

89 | 10.99 |

90 | 11.92 |

91 | 13.06 |

92 | 14.49 |

93 | 16.34 |

94 | 18.79 |

95 or older | 20 |

If, during the annual March 1 to April 30 AVC withdrawal window, you: | Then: |

|---|---|

Do not make an optional withdrawal from your AVC account. | OMERS will automatically withdraw the greater of your income amount or the $500 minimum and pay it to you in June. |

Make an optional withdrawal from your AVC account that is less than the income amount. | OMERS will automatically withdraw the difference between the two amounts from your AVC account and pay it to you in June. |

Make an optional withdrawal from your AVC account that is equal to or greater than the income amount. | OMERS will take no further action – an additional withdrawal is not required. |

Tax will be withheld from all withdrawals beginning the year you turn age 72.

Amanda is 72 years old on January 1 and her AVC account balance is $40,000. The income amount on her AVC Annual Statement is $2,160 (5.40% of $40,000).

If, during the annual March 1 to April 30 AVC withdrawal window: | Then: |

|---|---|

Amanda does not make an optional withdrawal from her AVC account. | OMERS will automatically withdraw $2,160 from Amanda's account and pay it to her in June. |

Amanda makes an optional withdrawal of $1,000 from her AVC account. | OMERS will automatically withdraw the difference of $1,160 ($2,160 minus $1,000) from Amanda's account and pay it to her in June. |

Amanda makes an optional withdrawal of $2,160 or more. | OMERS will take no further action - an additional withdrawal is not required. |

Jonas is 72 years old on January 1 and his AVC account balance is $8,000. The income amount on his AVC Annual Statement is $432 (5.40% of $8,000). Note: The income amount is less than the $500 minimum.

If, during the annual March 1 to April 30 AVC withdrawal window: | Then: |

|---|---|

Jonas does not make an optional withdrawal from his AVC account. | OMERS will automatically withdraw $500 from Jonas’ account and pay it to him in June. |

Jonas makes an optional withdrawal. Note: He would have to withdraw at least the $500 minimum. | OMERS will take no further action – an additional withdrawal is not required. |

Direct deposit is fast, easy and convenient. When the income amount is paid from your AVC account or you make an optional withdrawal, your money will be deposited directly into your bank account. There's no waiting – your cheque will never be delayed or lost in the mail.

Use the AVC Income Option Direct Deposit Form to set up direct deposit.

Use this form to set up or change direct deposit for withdrawals from your AVC account, beginning the year in which you turn age 72.

How to Withdraw Funds (beginning the year you turn 72) To make an optional withdrawal during the annual March 1 to April 30 withdrawal window, you will need to use the paper Form 411 - AVC Income Option Withdrawal (members age 72 and older).

You will not be able to initiate your withdrawal using myOMERS.

Use this form if you participate in the AVC Income Option and wish to make an optional withdrawal from your AVC account.

Set up your AVC account online through myOMERS, which also gives you safe and secure access to your personal pension information. To get started, login to myOMERS.

Not registered yet? Registering for myOMERS is quick and easy, and comes with many more benefits in addition to AVC account set-up. With myOMERS, you can easily edit your profile, view reports and access helpful retirement planning tools like the Retirement Income Estimator.

Complete the AVC registration form (Form 401) to start, modify or stop automatic contributions to your AVC account. Use the AVC transfer package (Form 402) to transfer funds to your AVC account during the AVC transfer-in window from January 1 to June 30 of each year, until the year you turn age 70.