We’re here for you every step of the way – from the time you join until retirement. Every pay period, you contribute toward your OMERS pension.

Your OMERS pension can be one of your most valuable and secure assets. As a defined benefit pension plan, OMERS provides a guaranteed stream of retirement income for life, based on your earnings and years of service.

You will need your OMERS membership number, date of birth and the last three digits of your social insurance number to complete the registration.

Your Member Handbook covers your benefits in detail and is always at your fingertips.

Consider looking out for your loved ones by designating a beneficiary online in myOMERS.

If you have a pension from a previous employer, you may be able to transfer it into the OMERS Plan. If you cashed out your previous pension, you may qualify to purchase that time and convert it to OMERS service.

You contribute a percentage of your contributory earnings in each pay period to help pay for your future pension. Your employer also contributes an equal amount. These contributions will fund a portion of your pension. Investment earnings of the OMERS Fund will fund the balance.

Normal retirement age 65 members | On contributory earnings up to year's maximum pensionable earnings (YMPE)* | 9.0% |

On contributory earnings over YMPE* | 14.6% | |

Normal retirement age 60 members | On contributory earnings up to YMPE* | 9.2% |

On contributory earnings over YMPE* | 15.8% |

* The YMPE in 2024 is $68,500.

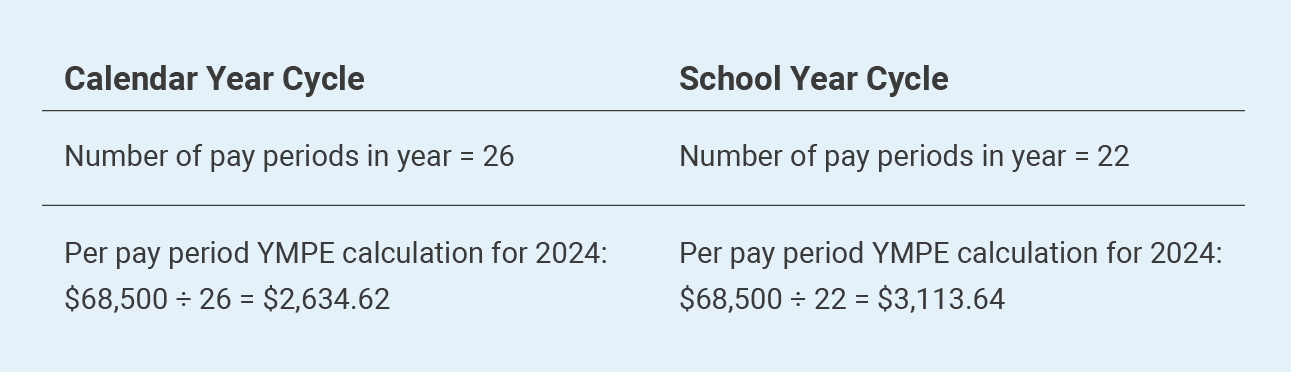

To calculate contributions, the YMPE must be divided by the number of pay periods in the year. This depends on your employer’s payroll cycles(s). See the examples below.

As noted above, you will make contributions in each pay period based on your contributory earnings in each pay period and the YMPE per pay period.

If your contributory earnings vary from pay period to pay period, your contributions will vary as well. Note that your contributions are determined based on your gross contributory earnings (i.e., before statutory and other deductions).

The YMPE per pay period is calculated as follows:

Employers use different payroll cycles over a year (e.g., monthly, bimonthly or biweekly), Many OMERS employers use payroll cycles that cover the entire calendar year whereas others have multiple cycles used for different employee groups, including cycles that run over the 10-month school year. Your contributions will be determined depending on what payroll cycle you are paid on.

See below for an example of what the YMPE per pay period calculation looks like where the pay period is bi-weekly for those on a calendar year cycle versus a school year cycle:

Note

If you only work for a part of a year, the YMPE per pay period calculation will not change (i.e., if you would normally be paid over 26 bi-weekly pay periods over a calendar year, the YMPE per pay period would be determined using 26 pay periods even if you only receive contributory earnings during a portion of those pay periods).

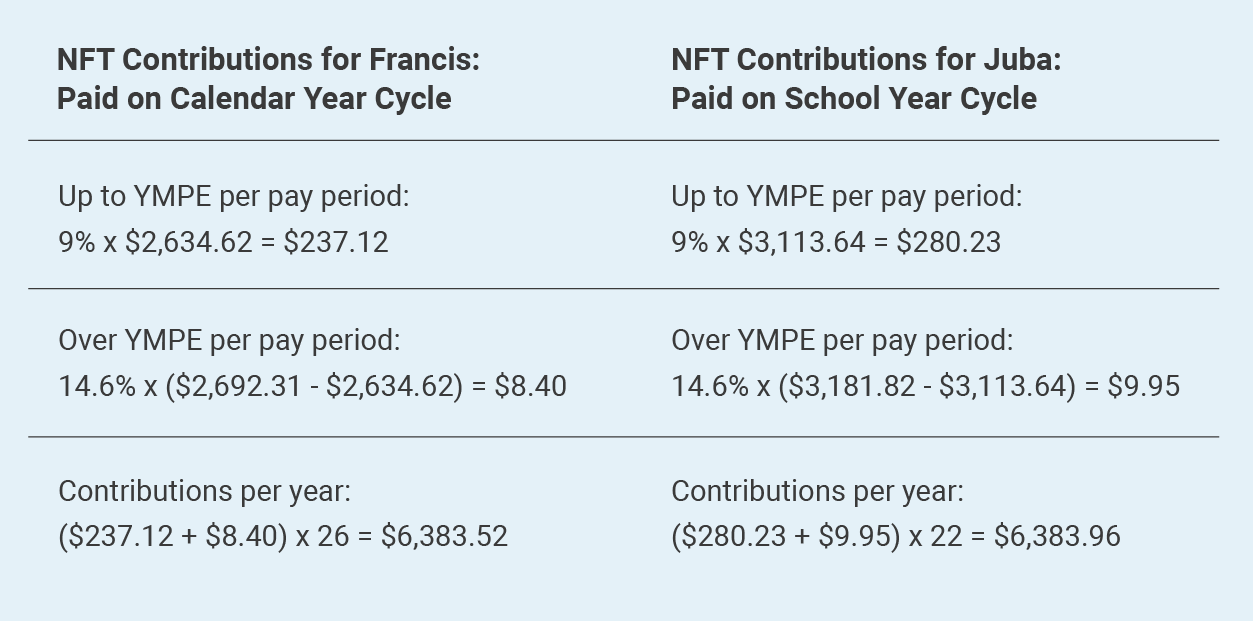

Francis and Juba are non-full-time (NFT) members who work for a school board and each are expected to earn $70,000 over 2024.

Francis works over a calendar year on a part-time schedule and is paid bi-weekly over 26 pay periods. In each pay period, Francis’ gross contributory earnings are $2,692.31.

Juba works a full-time schedule for 10 months each year from September to June and is paid bi-weekly over 22 pay periods. In each pay period, Juba’s gross contributory earnings are $3,181.82.

In many cases, if your current and previous periods of employment/service with your OMERS employers did not overlap and you did not transfer any part of your OMERS Plan benefit from the OMERS Plan or receive a refund of excess contributions (discussed below), your OMERS records may automatically be combined. In cases where your periods of service with your OMERS employers overlapped (including if your termination date with your former employer is after your enrolment date with your new employer), you may not be able to combine your service. See the Member FAQ.

If you previously elected a commuted value (CV) transfer from the OMERS Plan in respect of your prior service, your prior service cannot be combined with your current service but you may be able to buy back this service. You must wait five years from when you received your CV before you can buy back the service associated with the CV payment. See the Buying service page.

If your prior OMERS Plan benefit remains in the OMERS Plan as a deferred pension but you received a refund of excess contributions you made (i.e., a 50% rule refund), you could have a decision to make regarding whether to combine the service you earned with your former OMERS employer with what you're earning now with your new OMERS employer by repaying the 50% rule refund with applicable interest.

If you are currently receiving an OMERS pension and you are re-employed with an OMERS employer, you will need to decide to stop receiving your pension if you wish to re-enrol in the OMERS Plan. If you decide to re-enrol in the OMERS Plan and you previously received a 50% rule refund, it must be repaid with applicable interest in order to combine your membership records.

Combining your memberships may or may not help you to retire with more pension. It's an important decision and some high-level information to consider is provided to the right. You may also want to speak to an independent adviser.

Your OMERS lifetime pension + bridge benefit to age 65

2% x credited service (years) x "best five" earnings

Less OMERS bridge benefit at age 65

0.675% x credited service (years) x lesser of "best five" earnings or $64,060

Equals your OMERS lifetime pension from age 65

$64,060 – the current five-year average (2020-2024) of the Canada Pension Plan’s (CPP) year's maximum pensionable earnings (YMPE).

Your deferred pension may be eligible to grow to match inflation increases every year if your service is not combined and you retain a deferred pension. More information about inflation protection for deferred pensions is available in the Member Handbook

If your contributory earnings are growing enough to equal or better, the applicable inflation protection, it may be better to combine your previous and current service, and to have these earnings apply to your combined service.

Note that increases in your contributory earnings and inflationary increases to the Canada Pension Plan (CPP) year's maximum pensionable earnings (YMPE) can also impact the amount of any applicable bridge benefit you may be eligible for.

If you combine your service, and then work for less than 60 months, OMERS has to use some of your earlier contributory earnings to calculate your "best five" earnings in order to determine your overall pension. If your contributory earnings now are higher, this combination of earnings could reduce the benefit you're earning in respect of your current service but increase the benefit you earned before. The overall result for you could vary.

In addition, consider when you terminated your prior employment with an OMERS employer. If your previous period of service included post-2012 service and you terminated employment prior to reaching your early retirement birthday [55th birthday for normal retirement age (NRA) 65, or 50th birthday for normal retirement age 60], then your deferred pension for post-2012 credited service would not include pre-retirement indexing or early retirement subsidies. If you combine your service and work with an OMERS employer until your early retirement birthday, your combined service will be eligible for pre-retirement indexing and early retirement subsidies, as applicable.

When you left your previous employer and elected to leave (defer) your pension in the OMERS Plan, you were entitled to a refund of any excess contributions you made. If you want to combine your earlier and current service – to combine your OMERS pensions – you must pay back your 50% rule refund (if any). Note that the 50% rule refund must be repaid on a gross basis (i.e., the amount before applicable taxes) with applicable interest.

Will the amount you pay back to combine your service be offset by an increase to your overall pension? It depends on your personal circumstances, including the factors we've discussed above.

As noted above, the amount to be repaid is equal to the 50% rule refund (on a gross basis) plus applicable interest. OMERS will reach out to you to let you know the amount.

You can repay your 50% rule refund in one of two ways:

If you want to repay your 50% rule refund using RRSP funds, ask the financial institution that holds your RRSP for a Form T2033. Complete the required sections and return the T2033 along with your 50% rule repayment form to your employer.

The transfer of RRSP funds must be in the exact amount required to repay your 50% rule refund plus applicable interest. (We can't accept any overpayment.)

Note: The amount you transfer from your RRSP is not tax-deductible since it's going straight into the OMERS Plan (i.e., from one tax-deferred retirement savings vehicle to another).

If you use cash, the entire amount you pay is tax-deductible. However, there are different rules for repaying the portion of the 50% rule refund that relates to service from 1987-1989.

Please make your cheque payable to OMERS. OMERS will provide you with an income tax slip, which you must file with your income tax return to get the deduction.

If you have the option to and decide not to combine your service, each period of service will be kept separate and will be based on your "best five" earnings during each period. As noted above, this may result in a lower overall benefit. You will keep your 50% rule refund.